I. OWNERS OF REAL ESTATE

Owners of real estate in Greece can be divided in two main categories with different tax treatment:

a. Natural persons (individuals): the property belongs directly to natural persons for ownership, exploitation or investment.

b. Legal entities: the property belongs to companies for ownership, exploitation, investment, construction or rebuilding.

II. INCOME TAX

Any natural person or legal entity, earning income in Greece, is generally, obliged to submit annual tax income statements and be taxed for such income. The current tax treatment on real estate in Greece is as follows:

A. Individuals

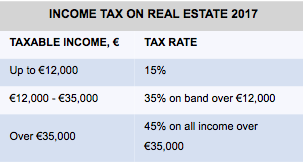

Income received from letting or leasing of immovable property are taxed at a rate of 15% for annual income up to €12.000, 35% on band over €12.000 and 45% on all income over €35.000.

The exercise of an undertaking by a natural person, who also earns real estate income, does not affect the above tax treatment for property income (i.e. it remains as income from real estate and not from business activity).

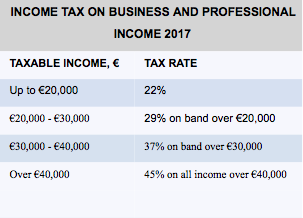

However, individuals owing immovable property for business and professional purposes, i.e. those whose scope of business is commercial exploitation, development and investment in real estate, are subject to income tax at a rate of 22% for annual income up to €20.000, 29% on band over €20.000, 37% on band over €30.000 and 45% on all income over €40.000.

This taxation applies to natural persons who run an individual real estate business in their name, such as owners of tourist premises (hotels, rooms to let etc.) and hold a Special Authorized License for this activity.

B. Legal entities

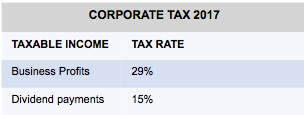

Corporations in Greece are taxed on their income in Greece and from overseas. Foreign companies in Greece are taxed only on income that is generated in Greece. The Corporate Tax Rate stands at 29% on all business profits (to be reduced to 26% as from 01.01.2019). Rents received from real estate are also considered as business profits. A withholding tax, at the standard rate of 15% applies to dividend payments and other profit distributions made by a Greek resident company.

Note: Pursuant to the law, intragroup dividends earned or distributed by Greek companies are totally exempt from tax withholding, provided that: (a) the distributing company or the recipient respectively, is covered by the Parent – Subsidiary Directive 2011/96/EU, is seated in an EU member state and is subject to one of the taxes provided in said Directive, (b) the recipient holds a minimum participation of 10% in the distributing company’s capital, shares, voting rights or profits rights, (c) the aforementioned minimum participation is held for at least twenty-four months. Exemption may apply as well before lapse of minimum required holding period upon providing cash guarantee equal to the amount of tax exemption.

III. PROPERTY TAX

Α. Single Real Estate Property Tax (“ENFIA”)

Single Real Estate Property tax (ENFIA) is imposed annually on natural and legal entities that possess Hellenic property. The tax base is the objective property value on January 1st of each year, as assessed by the tax authorities. This tax includes two different tax amounts:

- Primary tax. This tax is imposed on each property item and is determined by several factors, such as the surface, the price zone, the floor, the age of building, the facade, the percentage of ownership and other special circumstances.

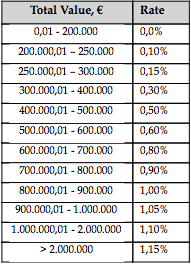

- Secondary tax. In respect of legal entities, this tax is imposed on the total value of the property of each owner and amounts 0.55% of the total value of all the properties. For immovable property which is used for the purpose of producing or carrying out any kind of business activity, irrespective of the nature of the business, this tax is calculated at a rate of 0,10%. Concerning individuals, this tax is imposed on the total value of the property of the owner which exceeds €200,000; the excess amount is subject to a secondary tax, ranging from 0.1% to 1.15% as follows:

B. Special Real Estate Tax

According to Greek Law 3091/2002, legal entities in general, that have full property rights or bare ownership or usufruct property in Greece, are liable to pay a yearly special property tax at the rate of 15% of the properties’ total value. The Law provides exemption from the obligation to pay the above-mentioned tax for many cases that are related mainly to the nature of the activity of legal persons. Also, an exemption from this tax obligation is provided for companies that have their headquarters in Greece or another EU country and are: a) S.A. companies with registered shares to individual or S.A. companies that indicate the individuals who own their shares, provided that those individuals have been awarded with a tax registration number in Greece, or b) companies of other types, if the shares are owned by individuals or if these companies declare the beneficial owners of their shares, provided that these individuals have been awarded with a tax registration number in Greece.

IV. SHORT-TERM LEASE FRAMEWORK

Under Law 4446/2016, it is possible for individuals to make short-term lease agreements of their real estate property via digital platforms for a limited period not exceeding one year, provided that the property’s administrator is registered in the Short-Term Property Leases Register, which is kept by the Secretariat of Public Revenues.

Under a Joint Ministerial Decision, restrictions on the short-term lease agreements may be stipulated, such as that each individual can lease up to two (2) properties and that the short-term lease cannot exceed ninety (90) days per property, for each calendar year and sixty (60) days for properties located on an island with a population lower than 10.000 residents. Exception to the rule of the 90-day lease may apply in cases when the total income from all the properties that are leased does not exceed the amount of €12.000 for each tax year.

The leases, in this case, are taxed as per revenue from real estate property according to the abovementioned progressive tax rates (15% – 45%), and are not subject to VAT.

In case that any other services than the lease of a furnished property with bed linen are provided or in case that the lessor runs an undertaking as a tourist professional, rents received are considered as business and professional income and are taxed as such, according to the progressive rate mentioned above (22% – 45%).

V. CORPORATE REAL ESTATE

Two structures are most commonly used for real estate investments via a legal entity. The one is the direct acquisition of the property, or asset deal, which follows the same procedure as the transaction between individuals. The other is indirect means, by acquiring a controlling stake of the entity owning the property, the share deal. The share deal is more frequently used as it allows quicker and easier change of ownership while providing a quick exit strategy for the buyer when it eventually sells the real estate. In this case there is a capital gains tax (15%) imposed on the difference between the purchase price and the selling price of the shares.

Companies owing real estate for commercial purposes (exploitation, development, investment) can deduct several expenses from their total income, such as ENFIA tax, other operating costs relating to the properties, the amount of the director’s social contributions etc. In addition, an annual depreciation in the value of buildings is calculated and deducted from the total income. All these deductions result in the reduction of the company’s taxable income.

The legal forms most suitable for the ownership vehicles are:

- Company limited by shares (SA or AE in Greek)

- Private Company (PC or IKE in Greek)

a. Company limited by shares (AE)

Societe Anonyme, S.A. (Anonymos Etairia in Greek) is a company subject to increased state supervision, incorporated by one or more shareholders and governed by a board of directors, consisting of three (3) members at least. SA company is regulated by Law 2190/1920, as it has been modified and in force. A minimum share capital of €24.000 is required for establishing an SA and may be cash or in kind contribution.

SA is a capital company with legal personality and its property is separated from the one of its owners, i.e. the company is the only one liable for the corporate obligations by its own assets (with exceptions as per public-law debts).

b. Private Company (IKE)

IKE is a recent type of a capital company with legal personality, regulated by Law 4072/2012. No minimum share capital is required for establishing an IKE.

IKE is the only one liable by its assets, for its corporate obligations, excluding the liability undertaken primarily by the partner, with guarantee contributions (and exceptions as per public-law debts). Main characteristic of this type of company is the possibility for the partners to provide and to undertake company shares not only with capital but with other types of contribution as well: the non-capital contributions (e.g. work) and the guarantee contributions, whose value cannot extend beyond 75% of the liability undertaken by the partners against creditors of the company.

IKE is a flexible and easy to be established company type and its originality consists in the utilization of goods other than capital, for example the promise of work and services or the loan guarantee. Through IKE and the statutes and the agreements of the partners, arises the possibility for these non-capital and guarantee contributions to be capitalized and business profit to be created.

IKE can be incorporated by one or more shareholders and is governed by one or more directors. The director, who may be one of the shareholders or a third party, and the sole shareholder of a single-member IKE, are legally obliged to register with the National Social Insurance Fund (EFKA) and are subject to the statutory social insurance contributions, while the registration of other members of IKE is optional.

VI. CONCLUSION – PROPOSALS

According to the above, three (3) are the possible ways for investing in real estate:

a) as an individual who owns property and makes lease agreements as a non professional.

b) as a professional individual who runs a real estate business and holds a Special Authorized License for this activity.

c) via a legal entity/company whose core business is real estate exploitation.

Οwning immovable property through a legal entity has a number of advantages. The most important are the following:

- The more favorable tax regime for high incomes [29% on all taxable profits, to be reduced to 26%, while for individuals (professionals or not) may be raised up to 45%, lower ENFIA secondary tax rate],

- The possibility to deduct various expenses (ENFIA, depreciations etc.) and reduce respectively the taxable income,

- The distinction between the property of the company and the one of its owners, which may protect the owners in case the investment presents losses or against possible creditors, and

- The option for quicker and easier change of ownership by way of share deal (transfer of the company’s shares).

However, the operation of a company is associated with operating and administrating costs, relating to registration, keeping of accounting books, social contributions for the directors etc., most of which though may be deducted from the company’s total income. Besides, running an individual business is also subject to the same expenses.

In light of the foregoing, incorporating a legal entity with scope of business the exploitation and development of real estate seems to be a favorable and cost-effective option for an investor. An EU resident company is proposed to be the shareholder of the real estate company, so as to be exempt from dividends tax withholding (15%).

(published on BussinessNews.gr and FortuneGreece.com)